By Kayhan Life Staff

Mohsen Rezaei, Secretary of Iran’s Expediency Council, has said that the Council may issue its final decision on the Financial Action Task Force (FATF) Recommendations by March 21, the start of the Iranian New Year.

In comments reported by the Iranian Labor News Agency (ILNA) on Feb. 14, Mr. Rezaei said: “The Council has revisited the FATF’s articles following the Supreme Leader’s [Ayatollah Ali Khamenei] directives. It has nearly completed its review of the Recommendations.”

“Experts and researchers familiar with the issue have yet to respond to all the council members’ inquiries. They had provided us with some answers before, but the information was incomplete,” Rezaei explained. “I can say that we have nearly completed our review.”

“There is a strong possibility that we will issue our final decision by the end of the year,” Rezaei noted. “I cannot predict the outcome. [President Hassan] Rouhani has suggested that we attach a condition to the agreement, allowing us to withhold any information on bypassing the sanctions.”

“We must study this proposal and determine if we can provide all the information to the FATF except on circumventing sanctions. Therefore, we must address every concern before making our final decision,” Rezaei added. “A small minority suggests that we withhold the information about ways to bypass the sanctions from the FATF. Others argue we should share all information with the FATF’s central committee.”

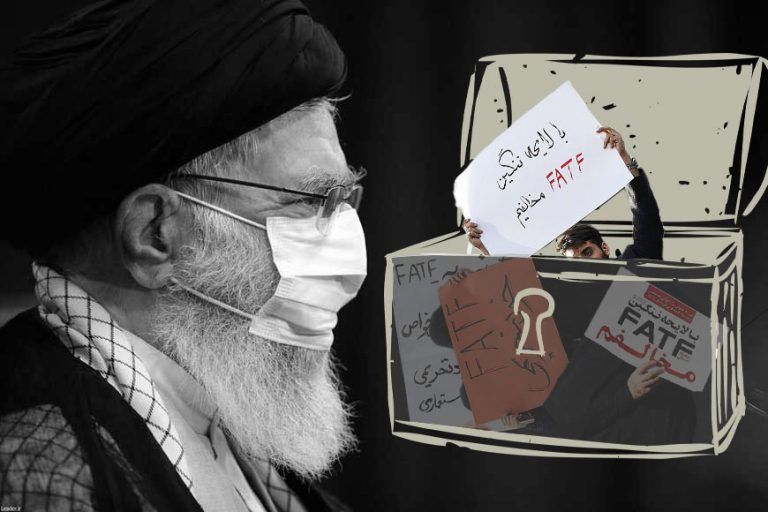

[aesop_image img=”https://kayhanlife.com/wp-content/uploads/2020/02/2019-11-04T111740Z_1670850742_RC1B145C2250_RTRMADP_3_IRAN-USA-EMBASSY-scaled.jpg” panorama=”off” credit=”FILE PHOTO: State sponsored protesters burn an FATF banner as they attend an anti U.S. demonstration, marking the 40th anniversary of the U.S. embassy takeover, near the old U.S. embassy in Tehran, Iran, November 4, 2019. REUTERS./” align=”center” lightbox=”on” captionsrc=”custom” captionposition=”left” revealfx=”off” overlay_revealfx=”off”]

The Majlis (Iranian Parliament) passed the Palermo Convention and Countering the Financing of Terrorism (CFT) and Anti-Money Laundering (AML) nearly two years ago, but the Guardian Council rejected them. The bills were, subsequently, sent to the Expediency Council for review more than a year ago.

In February 2020, the FATF blacklisted Iran for failing to enact the Palermo Convention, the CFT, and the AML, blocking Iran from international banking system transactions.

In December, Mr. Khamenei instructed the Expediency Council to revisit the FATF Recommendations’ principal components to pave the way for Iran to rejoin the international banking and financial systems.

To restart its economy, Iran must access the Society for Worldwide Interbank Financial Telecommunication (SWIFT), a system used for banking transactions, which is only possible if the FATF removes the country from its blacklist.

The FATF is an intergovernmental organization founded in 1989 on the initiative of the G7 to develop policies to combat money laundering and terrorism financing. It operates under the Organization for Economic Co-operation and Development (OECD) auspices, an intergovernmental economic organization with 36 member countries, founded in 1961 to stimulate economic progress and world trade.

The United Nations Convention against Transnational Organized Crime (UNTOC, also called the Palermo Convention) is a 2000 UN-sponsored multilateral treaty against transnational organized crime.

President Rouhani and his allies have long called for the Expediency Council to enact the FATF’s Recommendations, arguing that it will give Iran access to international banking and financial systems.

The opponents of the measure fear that complete transparency and accountability will hinder Iran’s ability to fund its regional military activities and armed Shia militia groups.

Iran Barred from International Financial System After Blacklisting by FATF

In an interview with the Iran newspaper earlier this month, Mr. Rouhani’s Vice President for Legal Affairs, Laya Joneydi, said: “To enact the Palermo Convention requires only a coordinated effort in line with the Constitutional process. The [Expediency] Council must review the remaining issues raised by the Guardian Council regarding the CFT.”

Some officials oppose the ratification of the Palermo Convention and the CFT.

In a Feb. 16 interview with the Mehr News Agency, Javad Nikbin, a member of the Majlis cultural and research committee, said: “In 2014, President [Rouhani] said that foreign sanctions caused 20 percent of the country’s problems. I agree with the president’s remarks completely.”

“I am convinced that joining the FATF will solve none of the country’s problems. It will only exasperate the difficulties caused by the sanctions,” Mr. Nikbin added. “I, therefore, call on the Expediency Council to defeat the proposal.”

Habibollah Abdolmaleki, the deputy director for employment and self-sufficiency at the Imam Khomeini Relief Foundation, who opposes the FATF ratification, recently said: “Joining the FATF will force the Islamic Republic to accept one political and two economic conditions which will reinforce the sanctions. It will require us to designate freedom movements, including Hamas and Hezbollah, as terrorist organizations. The global hegemony will control all our international banking transactions and domestic judicial system.”

Economists and experts have warned the Expediency Council and the Majlis that Iran will remain on the FATF’s blacklist should they decide not to enact the Palermo Convention and the CFT. As a result, Iran cannot access the SWIFT and international banking and financial systems.

In an interview with ILNA on Feb. 16, Hossein Salimi, the director of Iranian and Foreign Joint Venture Investment Association (IFJIA), said: “Everyone knows the significance of foreign investment, and issues related to the FATF and international banking transactions. No foreign company can transfer funds in and out of Iran right now. That is the principal obstacle preventing foreign investment.”

“Three conditions must exist before any foreign company invests in a country, namely observing international laws and ensuring political and economic stability. Why should a foreign company invest in a country if it cannot take its profit out? Sanctions and issues related to the FATF discourage foreign investors.”

This article was translated and adapted from Persian by Fardine Hamidi

[contact-form][contact-field label=”Name” type=”name”][contact-field label=”Email” type=”email”][/contact-form]